Applydiscoverit.com invitation code | applydiscoverit.com 4 word code 2024: When you’re considering getting a new credit card, you’ll often come across different offers from different issuers.

One such offer is through applydiscoverit.com, which invites customers to apply for the Discover it® Credit Card. This article aims to explain in depth the importance of “ApplyDiscoverIt.com Invitation Code” and “ApplyDiscoverIt.com 4-Word Code”.

Features of the ApplyDiscoverIt.com Invitation Code and 4-Word Code

| Feature | Description |

|---|---|

| Uniqueness | Each code is unique to the individual to whom it was issued. |

| Exclusivity | It might offer special terms that are not available to the general public. |

| Ease of Application | Speeds up the application process by pre-filling certain information. |

| Limited Time Offer | Codes are generally time-sensitive. |

| Personalized Offers | May offer perks based on the customer’s credit profile. |

What is ApplyDiscoverIt.com Invitation Code?

“ApplyDiscoverIt.com Invitation Code” is a personalized alphanumeric code that is typically sent via mail or email to select individuals. This code is linked to a unique offer, often with special rates, rewards or terms not available to the general public.

After receiving the invitation, one can open the details of this exclusive offer by visiting applydiscoverit.com and entering this invitation code.

Why You Should Consider Using an ApplyDiscoverIt.com Invitation Code

Using the ApplyDiscoverIt.com invite code can provide many benefits, including:

- Streamlined Application Process: Your personal details can be pre-filled so that the process can be done quickly.

- Exclusive Offers: You can get better terms than publicly advertised.

- Fast approval: Since you are pre-selected to receive the offer, the odds of approval may be high.

ApplyDiscoverIt.com 4 Word Code: What Is It?

Although the ApplyDiscoverIt.com invitation code is commonly known, there is also a lesser known feature known as the “4 word code”. This is usually found with the invitation code and serves as an additional verification step. You enter this 4-word code along with your calling code to access your personalized offer.

Benefits of Using the 4-Word Code

- Extra security: Provides extra verification to make sure you mean to receive the offer.

- Improved Accuracy: Ensures the correct offer is displayed during the application process.

Applydiscoverit.com offers a variety of credit cards

- Cash Back Credit Card

- Student Cash Back Credit Card

- Secured Credit Card

- Student Chrome Credit Card

- Travel Credit Card

- Gas & Restaurants Credit Card

- NHL Credit Card

How to Apply Using the ApplyDiscoverIt.com 4 Word Code

The process of using these codes is straightforward:

- Go to applydiscoverit.com.

- Enter your calling code in the designated field.

- If prompted, enter a 4-word code for additional verification.

- Review the details of your offer and proceed with the application.

Enhanced Security and Peace of Mind

In the world of digital transactions, security is paramount. The applydiscoverit.com 4-word code adds extra security to your application process. A code is generated separately for your profile to ensure your personal information is protected throughout the app.

Accessibility and Convenience

The 4-word code not only saves time; It’s a lifesaver for those on the go. Wherever you are, as long as you have a code and internet access, you can go to the applydiscoverit.com 4-word code and complete your application in minutes.

Competitive Cashback Rates

With the Discover It Card, you can earn up to 5% cashback on different spending categories that change every quarter. Categories often include gas stations, grocery stores, restaurants, and online shopping.

The card automatically activates your cashback bonus, so you don’t have to opt in manually. Also, you can withdraw your cashback rewards at any time for any amount, providing a seamless user experience.

Zero Annual Fee and Other Cost Savings

Why pay to have a credit card when you can get all these benefits for free? The Discover It Card has zero annual fees, giving you more bang for your buck. Plus, you won’t experience foreign transaction fees, making it a great card for international travel.

Enhance Your Financial Health with FICO Score Access

Credit monitoring is an important aspect of maintaining and improving your financial health. With Discover It, you get FICO score updates directly on your report. This feature allows you to monitor your creditworthiness and make informed financial decisions.

Robust Fraud Protection for Worry-Free Spending

In today’s digital world, security is very important. Discover It Card comes with a comprehensive fraud protection system that includes 24/7 monitoring. If suspicious activity is detected, you’ll be alerted immediately, ensuring your financial assets are safe.

DiscoverPersonalLoans.com/Apply

Navigating the world of personal loans can be daunting. However, with options like Discover Personal Loans, the process is straightforward.

Here we explore what Discoverers Discover Personal Loans has to offer, how to use their online portal and more.

How to Use the DiscoverPersonalLoans.com/Apply Invitation Number

Getting a personal invitation number from Discover Personal Loans implies a pre-qualification process based on certain preliminary criteria. This is the first step in the simplified loan application process.

| Factor | Description |

|---|---|

| Application Portal | discoverpersonalloans.com/apply |

| Login Page | Discover Personal Loans Login |

| Contact | Discover Personal Loans Phone Number |

| Application Status | Discover Loan Application Status Portal |

| Eligibility & Requirements | Discover Personal Loans Requirements |

| Customer Feedback | Discover Personal Loans Reviews |

Discover Personal Loans Login and Access

Login to the portal is user friendly. After going to the Discover Personal Loans login page, you need to enter your details. Existing customers can easily check their loan balance, interest rates and next due dates.

Reaching Out: The Discover Personal Loans Phone Number

If you have any questions or run into any issues, Discover’s customer support is readily available. By dialing the Discover Personal Loans phone number, you can speak to knowledgeable representatives who can guide you through any concerns you may have.

Tracking Your Discover Loan Application Status

Once you’ve submitted your application, it’s natural to be curious about its status. The Discover Loan Application Status Portal allows you to check real-time updates. Whether your loan is pending, approved, or requires more information, you’ll always be in the loop.

Discover Personal Loans Requirements: What You Need to Know

Every lending company has its criteria, and Discover is no different. Some of the primary Discover personal loan requirements include a good credit score, proof of steady income and relevant identification documents. It is advisable to collect all the necessary documents in advance to speed up the process.

Honest Feedback: Discover Personal Loans Reviews

Before getting a loan, it’s important to hear from others who have gone through the process. Discover Personal Loans Reviews provide invaluable insights from real customers. While most reviews praise the company for its competitive interest rates and transparent terms, it is always good practice to read multiple reviews to get a comprehensive understanding.

REda Aslo: Discover It Credit Card Pre-Approval

Benefits of the Discover It Card

With its robust cashback program and other offers, the Discover It Card has rapidly gained popularity among credit card users.

Rewarding Cashback Program: Cardholders can earn 5% cash back every quarter on everyday purchases at grocery stores, restaurants, gas stations, select rideshares and online shopping. Plus, Discover will match your earned cash back at the end of your first year!

No Annual Fee: Unlike some cards that come with high annual fees, the Discover It Card is free, ensuring cardholders get maximum value from their rewards.

Flexible Redemption: Earned cash back never expires, and there are multiple ways to get your rewards, from statement credits to gift cards or direct deposits.

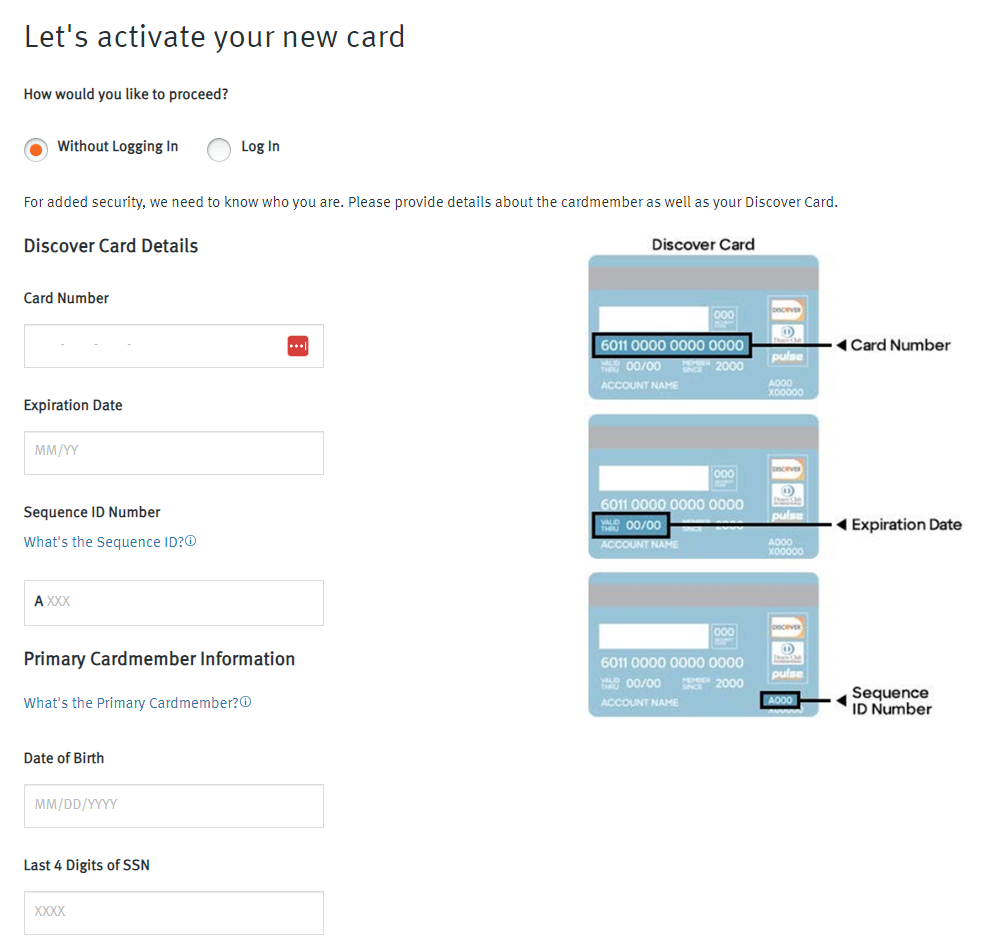

How to Activate Discover Credit Card

Activation Methods

Discover offers many convenient ways to activate your credit card. Choose the option that best suits your preferences:

1. Online Activation

- Enter your card details as prompted.

- Follow the on-screen instructions to verify your identity.

- Once verified, your card will be activated.

2. Phone Activation

- Dial the toll-free number given on the activation sticker.

- Follow the automated prompts.

- Provide required card information and personal details.

- Once done, your card will be activated.

3. Discover Mobile App

- If you have the Discover mobile app, sign in or download it.

- Go to card activation section.

- Enter the required card details and follow the prompts.

- Your card will be activated in few minutes.

4. In-Person Activation

- If you prefer a face-to-face approach, visit a local Discover branch.

- Provide your credit card and identification.

- A customer service representative will assist you in the activation process.

Discover Credit Card Customer Service Number

An often overlooked but significant aspect of a credit card is customer service. With Discover It, you get access to a dedicated, US-based customer service team. They are available to assist you at all times to ensure that your queries and concerns are addressed promptly.

- US: Call 1-800-347-2683(English/Español)

- Outside the US: Call 1-224-888-7777(English/Español)

Mail Address:

Discover Financial Services

P.O. Box 30943 Salt Lake City,

UT 84130-0943

ApplyDiscoverIt.com 4 Word Code Tips

- Keep your call code handy throughout the application process.

- Before starting the application, make sure you have all the required information (your social security number, income details, etc.) ready.

- If you have any questions or encounter any problems during the application process, you can usually find customer service contact information on the ApplyDiscoverit.com website.

Always remember to review the terms and conditions of the credit card offer before applying to understand the card’s features, benefits, fees and interest rates. This will help you make an informed decision about whether a Discover card is right for you.

How to Apply for a Discover Balance Transfer Card?

- Go here to find all credit cards.

- Next to the Discover credit card you want to apply for is an “Apply Now” button.

- After entering the required data, such as your date of birth, ZIP code, and the last four digits of your Social Security number, click “Continue.”

- Next, fill in the required fields with your name, residential address, date of birth, social security number, gross monthly income, rent or housing payment, and email address.

- After that, select “Get amazing balance transfer offer and go for three balances (optional)” and enter the required data like borrower’s address, name and account number.

- By clicking “Save Transaction” you signify your acceptance of the terms and conditions.

- Finally send the application.

Frequently Asked Questions

How long is my ApplyDiscoverIt.com invitation code valid for?

The validity period should be mentioned in your offer letter. Generally, these codes are time sensitive.

Can I use someone else’s calling code?

No, these codes are unique to each individual and cannot be changed.

What should I do if my 4 word code is not working?

In such cases, it is best to contact Discover’s customer service for assistance.

If I get a call code, is approval guaranteed?

No, the calling code does not guarantee approval. Your application will go through the usual credit checks and approval processes.

How do I use my Discoverpersonalloans.com/apply invitation number?

To start the loan application process, visit the specified URL and enter your personal invitation number.

I forgot my login details for Discover Personal Loan. What can I do?

Go to the Discover Personal Loans login page and click on the ‘Forgot Password’ or ‘Forgot Username’ option. Follow the prompts to reset your credentials.

Can I check the status of my loan application over the phone?

Yes, you can call Discover Personal Loans phone number and provide your application details to get real-time status updates.

What if I don’t meet all of the Discover Personal Loan requirements?

Each application will be reviewed individually while meeting all requirements. Sometimes, there may be flexibility depending on various factors.

How reliable are Discover Personal Loan reviews?

While reviews provide a glimpse into user experiences, be sure to take each one with a grain of salt. Note the overall feel and patterns in the feedback.

Are there foreign transaction fees with the Discover It Card?

No, the Discover It Card does not charge any foreign transaction fees.

How does the First Year Cashback Match work?

At the end of your first year as a cardholder, Discover will automatically match any cashback you’ve earned. It will be given only once to new cardholders.

Final Words

Receiving an ApplyDiscoverIt.com invitation code or 4-word code is your chance to explore a personalized offer for a Discover it® credit card. This not only streamlines the application process but may also offer better terms and rewards. However, it is important to thoroughly review the offer and consider its compatibility with your financial needs and goals.